Credit cards seem to have taken consumerism by storm in the past decade. According to a Transunion report, credit cards experienced a 60% annual growth from 2020 to 2021, with millions more signing up for one.

But what about those who don’t have a credit card, or prefer not to use one? That’s where buy now, pay later (BNPL) comes in.

BNPL is a form of short-term financing where consumers can—you guessed it—buy an item now and pay for it later. There’s often no extra charge to the customer. Instead, the store that offered BNPL as a payment option typically pays a fee to the BNPL service provider.

BNPL is surging in popularity because of the ease and convenience it provides to shoppers. Let’s dig a bit deeper into what BNPL is, how it works, and the key players that make it happen for today’s customers.

Start selling online now with Shopify

Start your free trial

What is buy now, pay later (BNPL)?

A buy now, pay later plan offers an installment loan to customers at checkout so they can buy products on credit without a credit card. Popular BNPL options include Shop Pay Installments from Shopify, Afterpay, Affirm, and Sezzle.

Many providers first run a soft credit check on the customer, then release the funds for an installment loan. Customers get different options for settling the loan balance, depending on the amount borrowed and the company used.

Some BNPL companies charge fees for late payments or default fees, and some payment options incur interest while others do not. Some providers may offset the low interest charged to the consumer with the fee that they charge the merchant.

How BNPL works?

The BNPL process is driven by consumers and retailers. Here’s how it works:

- A customer adds an item to their cart and initiates the checkout process. As a customer, you’ll start the BNPL process as you would any other ecommerce transaction. You’ll visit your favorite online stores, choose merchandise, and prepare to pay.

- The retailer’s BNPL partner offers the option to buy now and pay later. At checkout, the customer will have the option to pay using BNPL, along with other payment choices like debit or credit cards.

- A soft credit check is performed on the customer. When the customer opts to buy their merchandise using BNPL, they provide some personal details to the lender (such as an address and Social Security number). The BNPL lender then runs a soft credit check on the customer to ensure they have the financial standing to pay back their loan based on their credit history.

- The BNPL service deducts a fee. The BNPL vendor will now bill the retailer, taking a percentage of the retail transaction as a fee. The fee, which is typically between 2% and 8%, is cut from the amount the BNPL provider remits to the merchant. This works similarly to the arrangements credit card providers have with retailers.

- The customer pays off the loan over time. Many BNPL companies offer interest-free payments to customers who settle their full balance in a short period (typically 30 days after using BNPL). If customers need more time to pay off their balance, the lenders provide different payment plans with varying interest rates. In short, the faster a customer pays off the bill, the less overall interest they pay.

Benefits of BNPL for customers

Consumers gain many potential advantages when using a BNPL service, such as:

No impact on credit score

Most BNPL companies run soft credit checks on their clients to validate their eligibility for a loan. Soft credit checks do not affect your credit score like a hard credit check, so you’ll remain in the good books of potential lenders. But keep in mind that if you are late in your payments to the BNPL vendor, it will get reported to credit bureaus, similar to when you’re late on credit card payments.

Flexible payment options

As a customer, you should get different payment options at checkout when using a BNPL service. Typically, you can choose between paying the full purchase price using the BNPL service and splitting your purchase between BNPL and some other payment method (such as a debit card).

Potential Interest-free payments

If you select a short loan period and pay the BNPL vendor on time, you can borrow money without incurring any interest.

Reduced reliance on credit cards

A BNPL service offers many of the same advantages as a credit card, albeit for small purchases. Some BNPL companies also provide a virtual card number that works similarly to a credit card. You can use this card number to complete payments on your favorite online retail stores. Your BNPL vendor’s official website or smartphone app will allow you to request a virtual card number with enough funds to complete your purchase.

6 best BNPL services

Retailers consider buy now, pay later services important because they’ve been shown to improve the customer experience. Due to this retailer preference, a number of BNPL vendors have popped up in recent years. Here are six well-praised options:

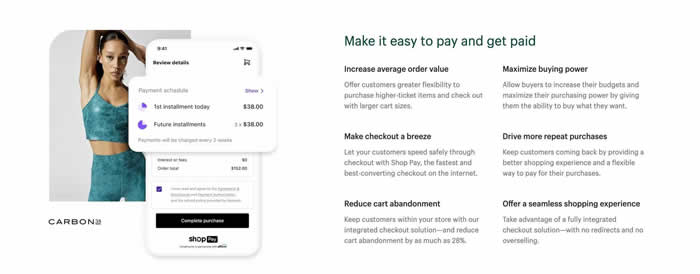

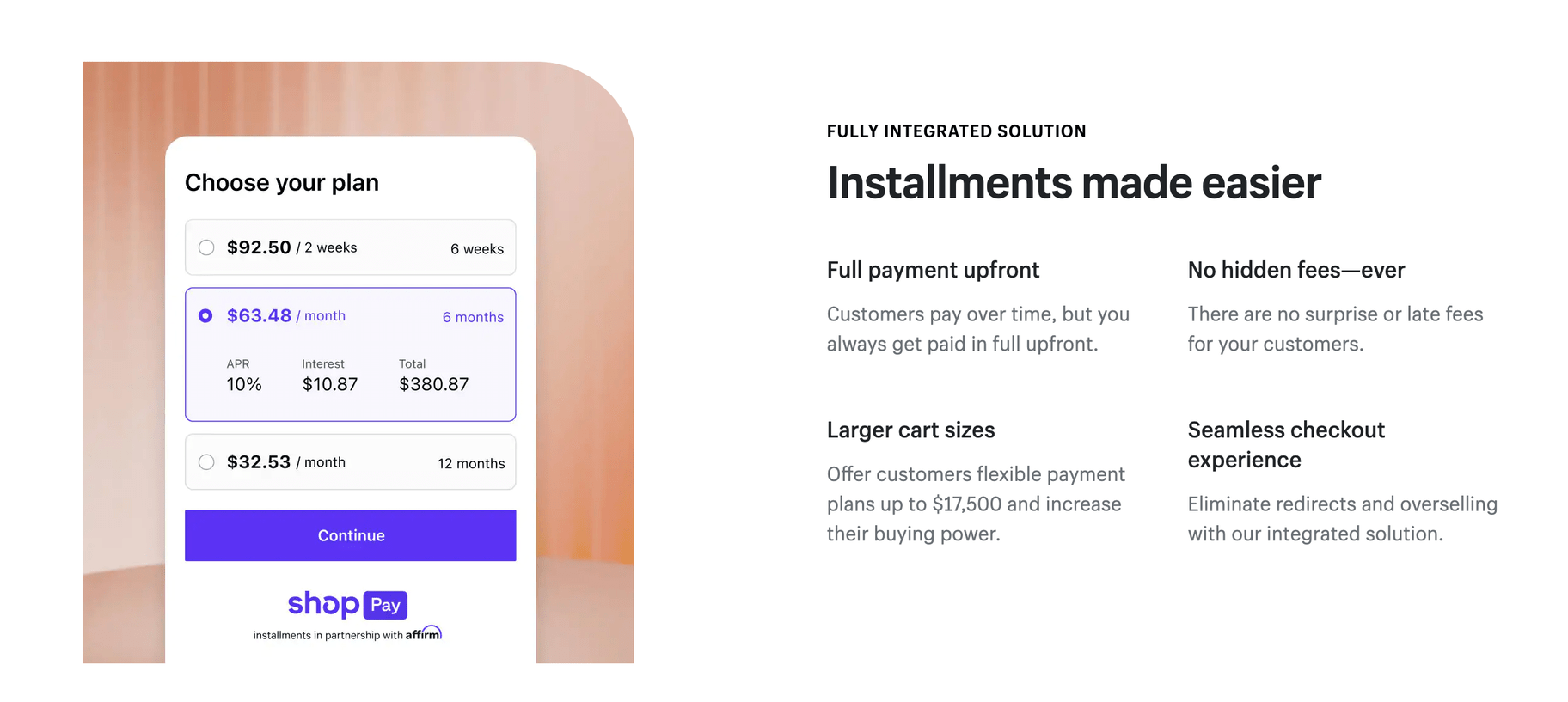

1. Shop Pay Installments

Ideal for retailers who are a part of the Shopify ecosystem, Shop Pay Installments allows customers to pay their balance in four interest-free installments. The BNPL service offers small businesses the same BNPL advantages enjoyed by major brands, including less cart abandonment and a larger average order value. As a Shop Pay user, you can help customers spread out the cost of larger transactions while still receiving the full balance at the time of purchase.

2. Afterpay

Founded in Australia, Afterpay is one of the biggest and most well-known BNLP service providers worldwide. The company partners with over 100,000 retailers, meaning it has a larger footprint than most other BNLP vendors on the list. One unique feature of Afterpay is its smart credit limiting tool. This technology places a spending limit on shoppers based on their credit background. The idea is to prevent them from spending more than they can pay back. Afterpay also helps customers stay on schedule by sending consistent reminders to clear payments. There’s even a virtual card service that works just like a credit card. However, there are late fees users need to be aware of if they can’t pay installments on time.

3. Affirm

Affirm is among the best BNPL services, with big retailers like Target and Amazon prominently offering it as a payment option. The company charges no fees and no interest for short-term loans, but requires interest payments with 10% to 30% APR on long-term borrowing. The interest depends upon the customer’s credit, but no fee is charged. For customers shopping at retailers that don’t already work with Affirm, it might be possible to use the service through a virtual card.

4. PayPal

One of the best-known online payment processing solutions in the world today, PayPal offers a range of services to businesses, from credit to business financing. It recently introduced its own BNPL offering called “Pay in 4.” Like many major BNPL services, Pay in 4 allows customers to purchase products directly and split their costs into four scheduled payments. However, the cost of the transaction can only be between $ 30 and $ 1,500 when you’re using PayPal. The major benefit of using PayPal as a BPNL vendor is credibility—most consumers are already familiar with PayPal and may have an existing account they can use.

5. Sezzle

Sezzle is popular around the world for its flexible payment options. There’s a signature feature of Sezzle that allows customers to push their payment due dates back by up to two weeks if they cannot pay the balance on time. Sezzle requires a 25% down payment on all purchases, but you can pay off loans without owing interest. The company has over 44,000 retail partners, including some large retailers such as Target.

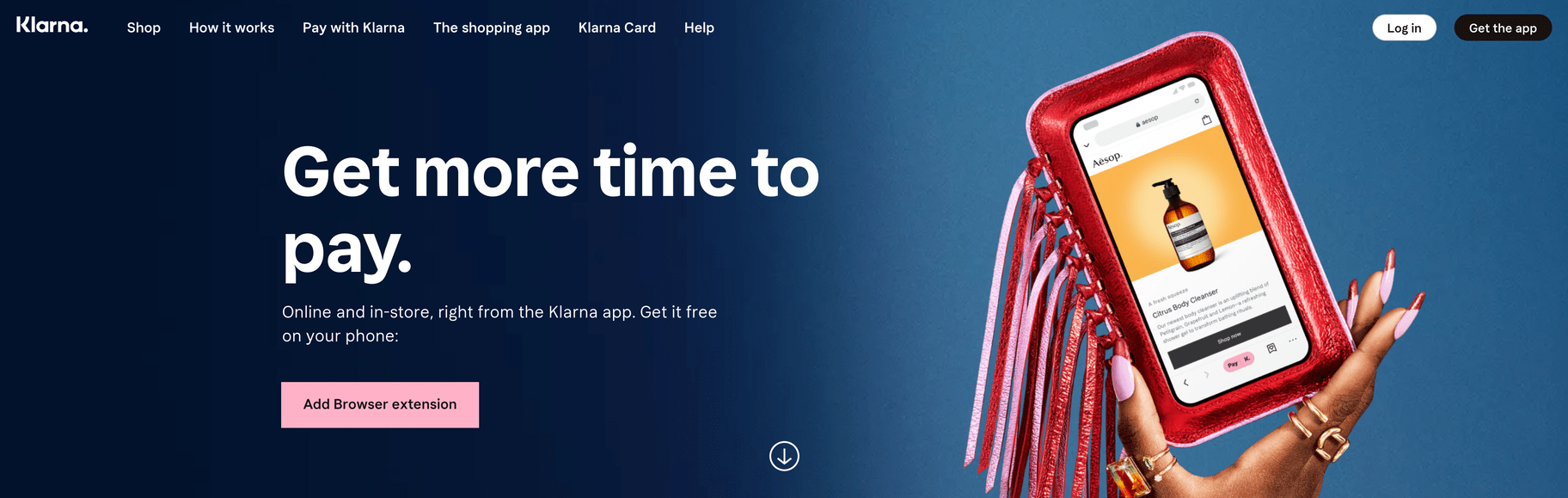

6. Klarna

Founded in Sweden, Klarna has over 85 million customers and partnerships with hundreds of thousands of retailers worldwide. Depending on how much money you need to complete a purchase, Klarna may sometimes conduct a soft or hard credit check. The company also uses a proprietary metric, called Purchase Power, to determine how much money users can access. Purchase Power looks at the user’s payment history within Klarna to determine how trustworthy they are. When you pay interest on your purchases, it maxes out at 25%.

Replace your layaway plan with BNPL

When considering BNPL for your business, you will have to consider two factors. One is the increased shopping carts of people who use a BNPL service. The other is the fees that BNPL providers charge on each purchase. Balancing these two considerations is critical to profiting from a BNPL option. Much like credit cards, the right BNPL service can inspire customers to spend more; the increased sales volume more than compensates retailers for the fees they’re paying.

Start selling online now with Shopify

Start your free trial

Want to learn more?

- Types of Ecommerce: 6 Options for Your Business

- Customer Lifetime Value for Ecommerce Stores

- Getting Traffic But No Sales? Here’s What You Need to Do

- Most Popular Ecommerce Payment Methods in 2022