Why Typical Store Locators Are Falling Off the Map

It’s no longer breaking news that customers want multiple ways to shop. Whether it’s through online ordering with curbside pickup or purchasing directly from a retailer, meeting the omnichannel demands of the modern consumer requires brands to support several buying options in the most useful, convenient, and accurate way.

In other words, we want our cake and we want to eat it too, but we also want to know exactly where we can locally buy the cake (preferably with multiple retailers listed so we can choose our favorite bakery and have a curbside or ship-to-home option available).

The most common way to inform customers of where to find a brand’s products is via a store locator on their website. Up until now, store locators have caused more headaches than added value for both consumers and brands:

Old data – The inventory data available for store locators is typically a couple of weeks old at minimum and is based on retailers’ point-of-sale (POS) data. Therefore, if a brand’s product is rung up at a register within the last couple of weeks, the item could still show up as in-stock at that location. This results in customer frustration when arriving at a…

suppliers.

suppliers. Team RangeMe at Natural Products Expo East 2022

Team RangeMe at Natural Products Expo East 2022

4th & Heart – Ghee

4th & Heart – Ghee

4th & Heart – Ghee

4th & Heart – Ghee

1981: Faye Pryor and her partners from Willowbrook

1981: Faye Pryor and her partners from Willowbrook

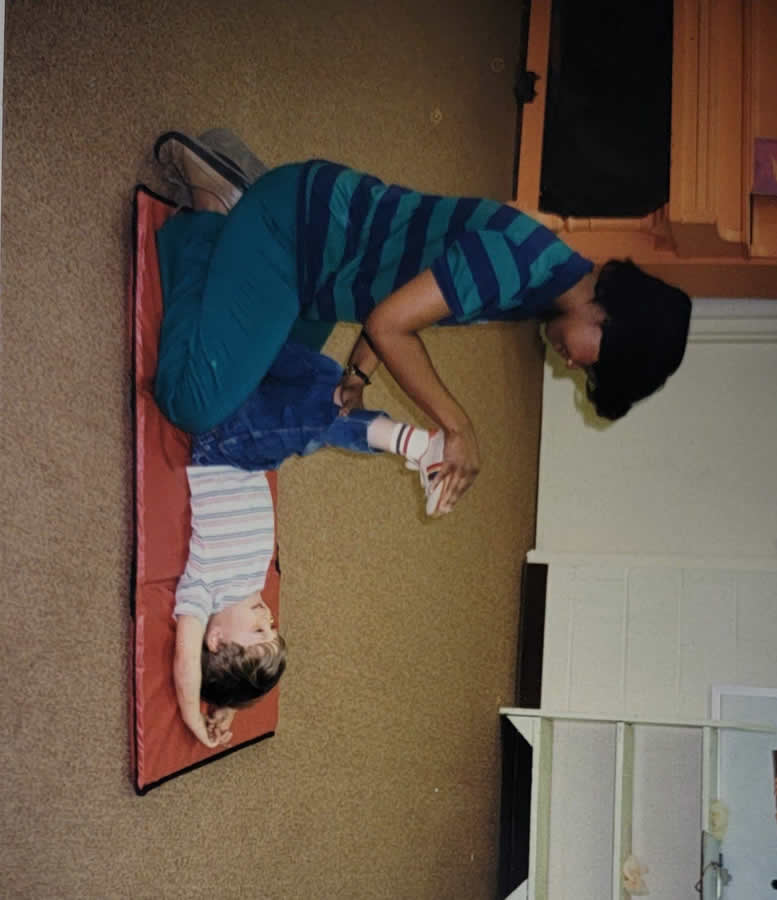

Faye Pryor practicing physical therapy in the 1980’s

Faye Pryor practicing physical therapy in the 1980’s

Faye Pryor practicing physical therapy in the 1980’s

Faye Pryor practicing physical therapy in the 1980’s

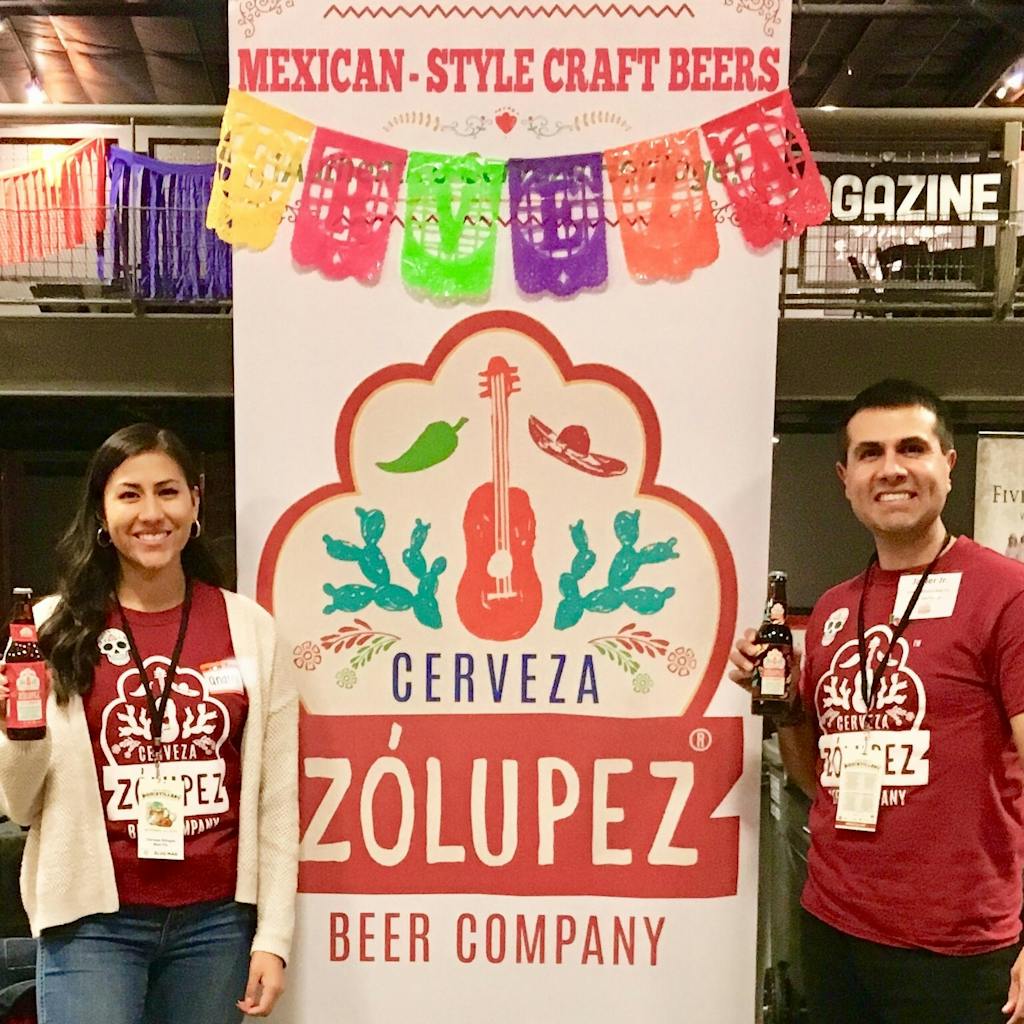

Javier Chávez, Jr., JD/MBA , Founder and President

Javier Chávez, Jr., JD/MBA , Founder and President