If you’re reading this wearing sweatpants, make-up free, with unbrushed hair, you’re not alone.

But with people starting to leave their homes more last year, the overall consumer health industry grew by 4% in 2021, according to Euromonitor International.

So, what’s driving sales of health and wellness products?

Multi-use products

Hybrid products mean consumers buy less but feel they’re getting more. Avon’s Anew Revival Serum has added AHAs; and Charlotte Tilbury’s Multi Miracle Glow Balm functions as a cleanser, overnight mask, and face and body balm/moisturizer. If only it did the laundry too.

Then there’s Olay’s 7-in-One Moisturizer which smooths fine lines and wrinkles, hydrates, evens skin tone, evens the skin’s texture, brightens, reduces age spots, and replenishes moisture.

With inflation hitting everyone hard, manufacturers are focusing on adding value to their products.

Personalization

Today’s consumers don’t want a generic product, they want a product for them.

According to Euromonitor International’s Voice of the Consumer: Lifestyles Survey in 2021, 51% of respondents stated they want products and services that are uniquely tailored to them.

Companies doing a good job at homing in on each individual consumer include Roman (for men, offering personalized treatments for everything from hair loss to erectile dysfunction), HUM Nutrition (to discover which nutrients you need), and Nurish (personalized vitamin packs).

This trend blends into haircare, too. Recently, Procter & Gamble launched Nou, in partnership with Walmart, recognizing that more than 50% of Generation Z are non-white. The brand offers many products, each focusing on different hair curl patterns.

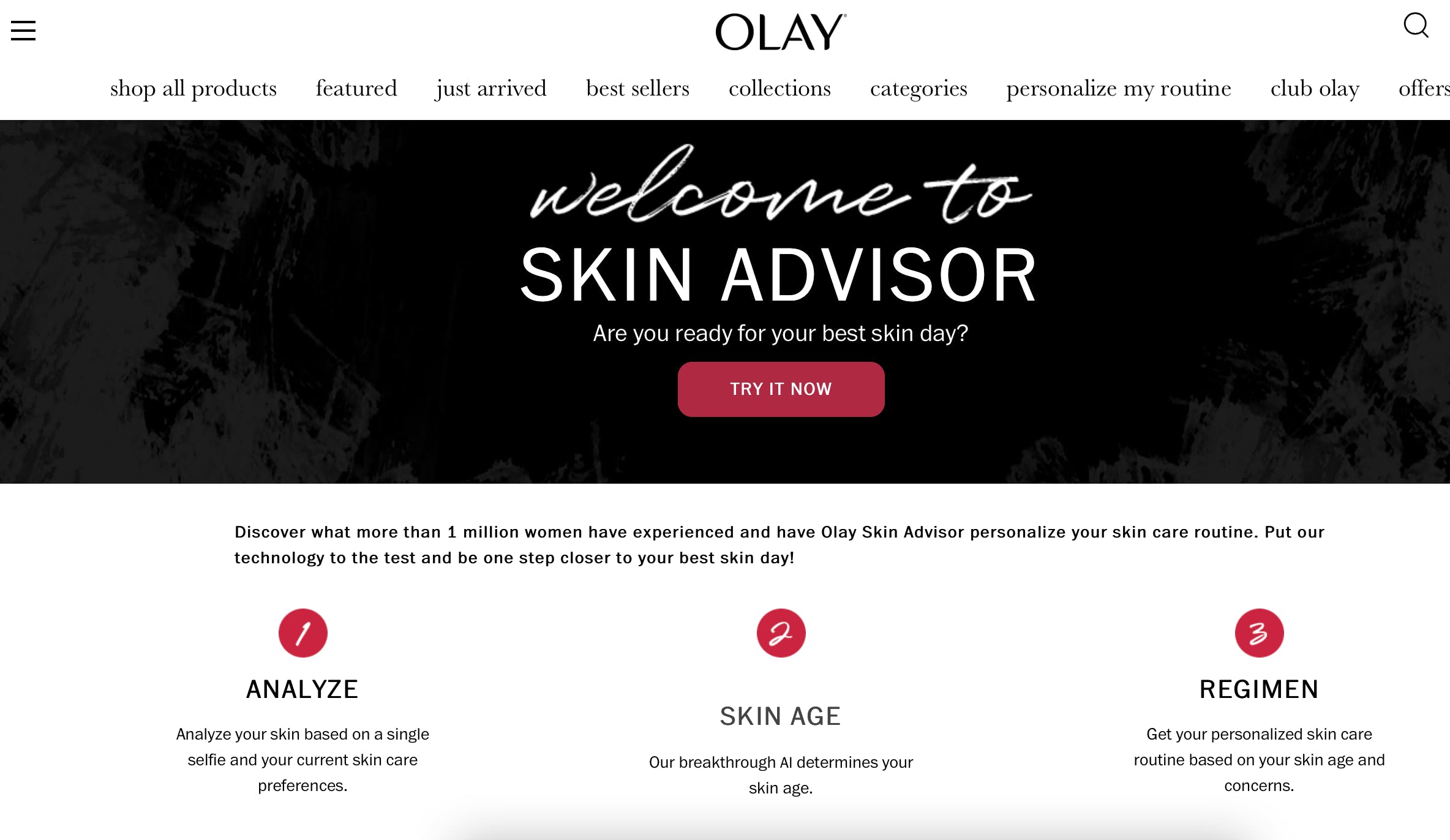

Mainstream brands are also getting into personalization. On its website, Olay offers a skin advisor and a moisturizing quiz.

Cerave’s website also has a quiz, so shoppers can find the right products that work for their skin type.

Inclusion and acceptance

According to Mintel U.K., 24% of British beauty and personal care consumers have stopped supporting a brand/retailer that was called out for racism and cultural insensitivities.

A larger focus has been placed on servicing all consumers since the Black Lives Matter movement, and companies are working hard to embrace this.

A slew of companies have launched products for Black consumers. In the U.K., for example, Superdrug is launching four exclusive brands for Black and mixed race shoppers: Nylah Afrocenchix, Mielle Organics, and Flora & Curl.

“As ingredient formulations and retailer accessibility improve, so too will the choice and quality of products available,” says Amy Rollinson, consultant, health and beauty, Euromonitor.

As well as products for Black consumers, there are now more products from Black entrepreneurs such as Kinky Curly, SheaMoisture, and Black Girl.

Hair is only one area, but product innovation for all consumers covers the whole body. Fenty Beauty has been recognized for offering foundation in 40 shades since 2017, and in 2020, Unilever launched melanin-focused skin care brand Melé, with products addressing dark spots and uneven skin tone. And that’s on top of the many companies offering gender-inclusive makeup, such as Morphe and Milk Makeup.

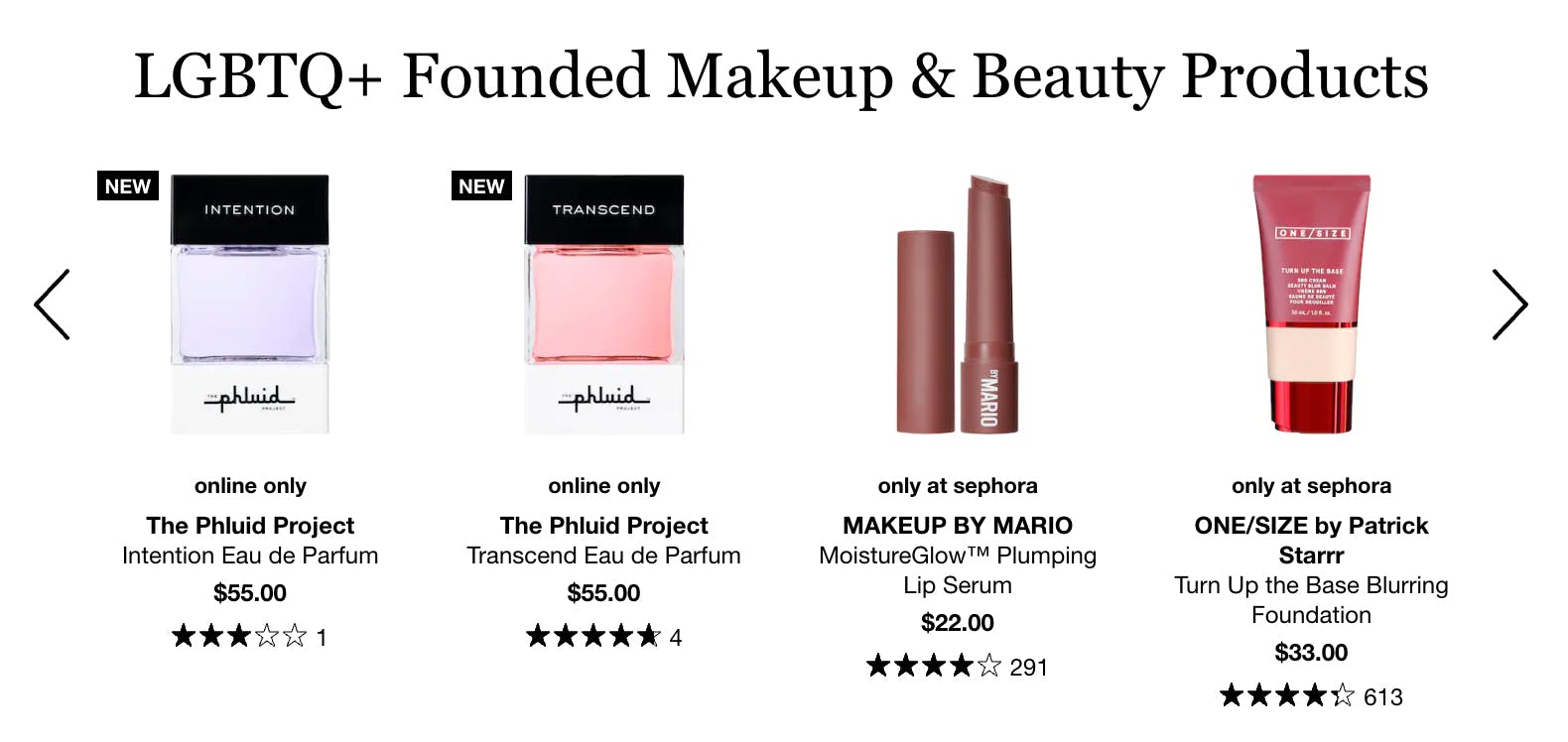

Retailers and suppliers are also supporting diverse genders. In June, many showed their support of the Pride movement. Olay offered a limited edition Pride jar for its nighttime moisturizer; and JVN’s Complete Hydrating Air Dry Hair Cream came in a Pride Edition. Sephora also offered an entire Pride collection, featuring LGBTQ+ founded makeup and beauty products.

Digital engagement

To really appeal to younger consumers, the more manufacturers do digitally is likely to bolster sales. A survey by Perfect Corp. in 2017 showed consumers were 1.6 times more likely to purchase beauty and skincare products from companies with augmented reality offerings.

In 2015, MAC added AR filters on Snapchat so users can try on and buy makeup; the brand has also added virtual make-up looks for avatars in The Sims video game; and virtual makeup try-on and virtual hair color try-on is offered through ModiFace, which L’Oréal purchased in 2018.

And then there’s a blurring of the lines between digital and physical reality. Spectra Eye Colour from The Unseen comes in two barely-there colors but transforms to a bright reflective look when exposed to a camera flash, appealing especially to younger consumers who photograph everything.

Emotional health

Whose emotional health didn’t take a hit during the pandemic? In Euromonitor’s Voice of the Consumer: Health & Nutrition Survey in 2022, 69% of Britons said their stress and anxiety “moderately or severely” impacted them.

Personal care companies are infusing their products with functional fragrances and essential oils. The Nue Co. conducted research in 2018 and found that with certain scents, including its Functional Fragrance, 96% of people felt instantly calmer. This company offers unisex products with functional fragrances such as bergamot and cilantro.

According to the website, “Smells can trigger both emotional and physiological responses. Put simply, scent is one of the fastest ways to alter your emotional state.”

Heretic Parfum has launched its first functional fragrance under the unusual name Dirty Grass. It contains CBD oil along with fresh and earthy notes, said to uplift your body and give a sense of balance. This company’s products are non-gendered and made with organic non-GMO sugarcane alcohol.

Wash your hair, moisturize your face, put on some makeup, and dab on some scent: You’re now ready for the post-pandemic world while hitting several trends. Whether you choose to change out of your sweatpants is up to you.

The post Micro Health And Wellness Trends Consumers Are Melting For: How To Drive Sales This Summer appeared first on The RangeMe Blog.