If there is one thing that all consumer packaged goods suppliers have learned over the past two years, it’s how interconnected our global economy is. Even a supplier that is local to its primary market is at the mercy of events happening on the other side of the planet.

Nowhere has this been more evident than with the rising costs of doing business, whether it’s due to scarcity of raw materials, supply chain bottlenecks, or increasing fuel and labor costs. At the same time, inflationary pressures are squeezing them from the consumer side, as shoppers are more cognizant than ever of spending.

I spoke with more than a dozen suppliers from around the world – some of them during a recent ECRM session – to get a sense of the challenges these brands are facing, and how they have adapted their businesses to accommodate them.

What it basically comes down to is that suppliers are getting hit on all fronts: rising costs of raw materials, shipping and freight (even local freight prices have gone up due to the increased fuel price). Labor is also getting expensive and can be scarce. Added to this are shipping backlogs at the ports, which means retailers are getting their products later, impacting suppliers’ cash flow due to delays in payments.

“We’re seeing cost increases literally everywhere,” says Shiv Joshi, Founder of Greystone Premium Organic Tea, Pointe Claire, Canada. “This includes our boxes, the beautiful tin foil envelopes we use in the packaging, the paper in which we put the tea bags, as well as the costs to move the product into and out of our warehouses and to the retailers. It has impacted everything across the board.”

Inflation just exacerbates the issue. According to NielsenIQ’s Managing Director of North America, Laura McCullough, who spoke at the GroceryShop 2022 Conference, consumers are employing an average of more than four different strategies to cope with our current economic times. These include stocking up on promotions, using coupons, turning to less expensive stores, and cutting back on non-essential items, prompting the need for brands to understand shoppers across buying channels and refine their strategies accordingly.

Despite getting squeezed on both sides of the supply chain, the suppliers I spoke with have come up with several different strategies to combat these cost increases. Following is a recap of these strategies.

Price Increases

Not surprisingly, most suppliers have had to increase the prices of some or all of their products. With the narrow margins that come from mass retail, there has been no way around this. Or, if a supplier hasn’t increased prices, they are offering less product for the same price, also known as shrinkflation. Fortunately, by now, most retailers understand the need for these price increases and have been very understanding when they happen.

“Consumers won’t accept price increases with our existing products,” says Allen Lever, CEO of Look Beauty, Toronto, Canada. “With our newer SKUs, we are already building in the margins to accommodate our cost increases.”

Moving the supply chain closer to customers

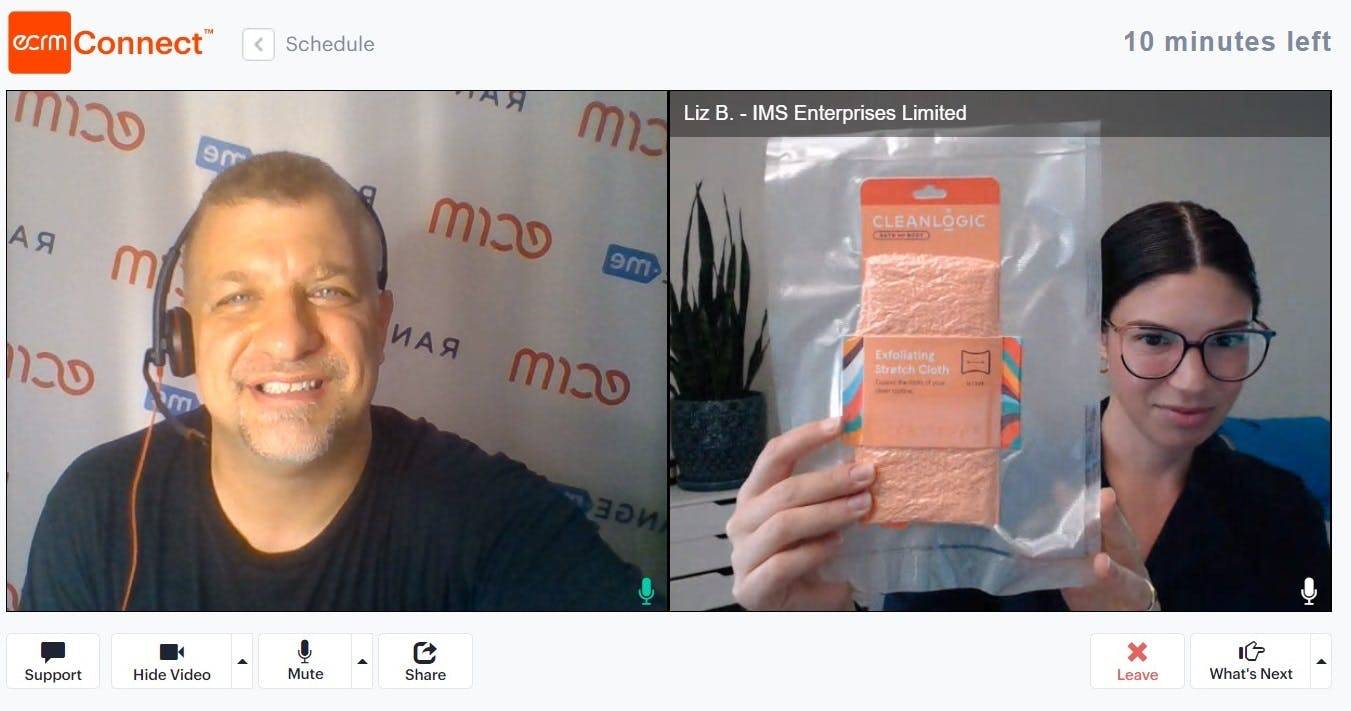

The cost of shipping containers overseas, particularly from China, has risen dramatically – in many cases even tripling.To avoid these costs, some suppliers have moved their supply chain closer to their customers, opening up manufacturing facilities where transportation can be done by truck. For example, the Philadelphia-based skincare brand Cleanlogic entered a joint venture in Mexico to manufacture top-selling products for distribution in both the U.S. and Latin America. “We just truck the products to avoid shipping costs from China,” says Liz Buncher, Director of International Sales and Marketing. The company also plans to establish a made in the U.S.A. product line to further diversify its supply chain.

By the same token, brands are seeking additional or new sources of supply closer to their factories. As Deutsche Post DHL Group’s CFO Melanie Kreis noted in a recent Bloomberg BusinessWeek article, “Everybody has realized that being dependent on just one supplier in one province in one country is probably not a good idea. So they want to build more resilience in the supply chain.”

Sourcing lower-cost ingredients/materials

Another way suppliers have offset rising costs is by substituting less expensive or more available ingredients or materials for their products while being careful not to sacrifice quality. Turkish beauty brand Evyap is currently looking for tallow suppliers to make its soap instead of using palm oil, which can be expensive. What’s more, Evyap is looking for tallow suppliers locally to use in the factories it relocated to Turkey.

Packaging efficiencies

Same goes for packaging. Cost savings can be found in packaging via several means. The first and simplest is finding less expensive packaging materials. “I recommend that my clients apply the 80/20 rule when it comes to packaging materials,” says Emily Page, CEO of Pearl Resourcing Brand & Packaging Design Agency. “Itemize all of your packaging piece parts and sort by cost from top to bottom. Circle the top 20 percent of the most expensive packaging piece parts and try to reduce costs on these, since 80 percent of your packaging costs probably come from this 20 percent. Reducing your most expensive packaging costs can be the quickest way to see savings.”

For example, Higher Education Skincare, Irvine, Calif., has reduced costs by eliminating secondary packaging on some SKUs. This move has the added benefit of being much more environmentally friendly, which was well-received by the brand’s younger customer base.

Page also recommends that suppliers ask their packaging partners about stock packaging or packaging sizes and types most frequently used that they can switch to. By using standard packaging materials, the mold or custom die fees manufacturers charge are reduced which can save several thousand dollars on a single production run. The same goes for paper. Moving to the most commonly used paper of your manufacturer reduces their costs and, as a result, your costs.

Smart packaging can also decrease costs by saving space and getting more products into a container for shipping. The more products you can fit in a container, the lower the cost-per-unit to ship, so packaging that reduces cubic volume is the way to go. Cleanlogic has started to use shrink-wrap packaging for some of its products, squeezing the air out of them so they take up less space (see photo below).

Cutting out the middleman

Suppliers who rely on distributors to procure their raw materials and packaging are now exploring the benefits of sourcing directly from the manufacturers themselves. Rio de Janeiro, Brazil-based Lola Cosmetics has seen significant cost-savings by going this route. “We used to buy our raw materials from a distributor who imported them,” says Václav Soukup, Export Manager. “Now we import them directly. The same goes for our packaging. We used to buy it from a local distributor, but now we make it ourselves.”

Lola serves markets in 34 countries and has adapted its operations to be more fluid and efficient when transporting its products. It now only accepts orders that can be shipped by sea and no longer uses air freight. It works with multiple freight forwarders to get the lowest prices.

Smart hiring

It certainly is good to be a sourcing or logistic expert these days. While many companies have instilled hiring freezes, they are making exceptions for skilled people in these two areas in an effort to find the best sources of supply and optimize their logistics operations.

Bringing in the robots

Okay Pure Naturals is a great example of a brand that has leveraged automation – specifically robotic units in its warehouse – to offset rising costs and the scarcity of labor. At any given time, one can see these robotic pallets zipping to and from various parts of its Florida warehouse. “The robots save us time and money,” says Hector Zuniga, Sales Manager. “Even if we are short on people, we can still move the same volume. This enables us to keep shipping out products on time. Before, we needed a lot of people to accomplish this.”

More selective with retailers

Rising costs have led many brands to make tough decisions about which retailers to work with and which to avoid or pull out of. Those retailers that require large trade spend from their suppliers are finding that suppliers are beginning to avoid them in favor of those with more favorable terms.

Direct-to-consumer

Some brands are even shifting more of their efforts toward direct-to-consumer (DTC) sales. Greystone’s Joshi started focusing more on DTC during the pandemic when retailers were only speaking with suppliers of essential-items, and many of which, he says, changed their payment terms from 30 to 90 days during that time. As a matter of survival, he needed to reach his consumers directly.

“We started building our DTC playbook during that time,” he says. “We hadn’t really done anything online. We had a website and sold a bit there, but haven’t invested a lot of time and resources. But we had plenty of time available during the pandemic and started building our presence on Amazon. We sought advice from our LinkedIn community and found a massive DTC community on Twitter, which helped us to better understand the nuances of how to work with Amazon and other platforms.”

All of the hard work paid off. Within three months of launching its line of Soursop Tea, which the company developed specifically at the request of a buyer, they were on the top page of search results among the other category leaders. At five months, his brand became Amazon’s Choice for all soursop tea. Greystone also earned the Amazon’s Choice banner for its Ginger Turmeric Tea.

“It’s doing so well it’s been hard to keep it in stock,” says Joshi. “I had to airlift two pallets to Amazon just to keep them available, and now we have containers rolling into our offices monthly. The profit margins we see in DTC are significantly higher than they are at retail. The best part is, launching a new product DTC is a fantastic way to demonstrate proof-of-concept, and when we do approach retailers, the Amazon’s Choice banners provide instant credibility.”

Moving forward: the importance of flexibility

The examples above highlight a key trait among suppliers who have been successfully navigating these cost increases: the ability to explore new options, be flexible and nimble, and not to be afraid of rethinking how you do business. Most brands I spoke with don’t see an end to these cost challenges anytime soon, but all agree that those who can adapt and come out on the other side will be stronger, more resilient and more effective operators from the experience.

The post How CPG Brands are Surviving – and Thriving – Amid Increasing Costs appeared first on The RangeMe Blog.