The sports nutrition market is rapidly expanding. Driving this trend is a growing awareness of the benefits of proper nutrition on athletic performance. Sports nutrition products have become integral to an athlete’s diet and training regimen. These products aim to improve performance, aid recovery after intense workouts, and reduce muscle soreness.

Today, sports nutrition products are consumed by athletes and non-athletes alike as part of a healthy lifestyle. As consumers continue to demand more from sports nutrition brands, companies must find new ways of staying ahead of trends. Using Evergi Social Listening data, let’s explore the sports nutrition ingredients and products that got consumers talking on social media over 2022.

Sports nutrition products getting the most buzz

In 2022, consumers continued to actively discuss sports nutrition products online. We observed a particular focus on protein powders, post-workout/recovery drinks, and sports drinks. Of all recorded sports nutrition products, mentions of sports gummies and jelly beans saw the highest growth rate. The category experienced a 343% increase in conversations between the first half of 2022 and the latter half of the year.

The sudden growth of this market may reflect the increasing popularity of easy-to-carry, hyper-portable products. We see gummies becoming more prevalent within the US CBD and US cannabis markets tracked by Brightfield Group as well. Sports nutrition products appeal to this desire for convenience as consumers resume their busy schedules. It may also reflect a general increase in interest in nutrition supplements as people seek more convenient means of boosting their nutrient intake.

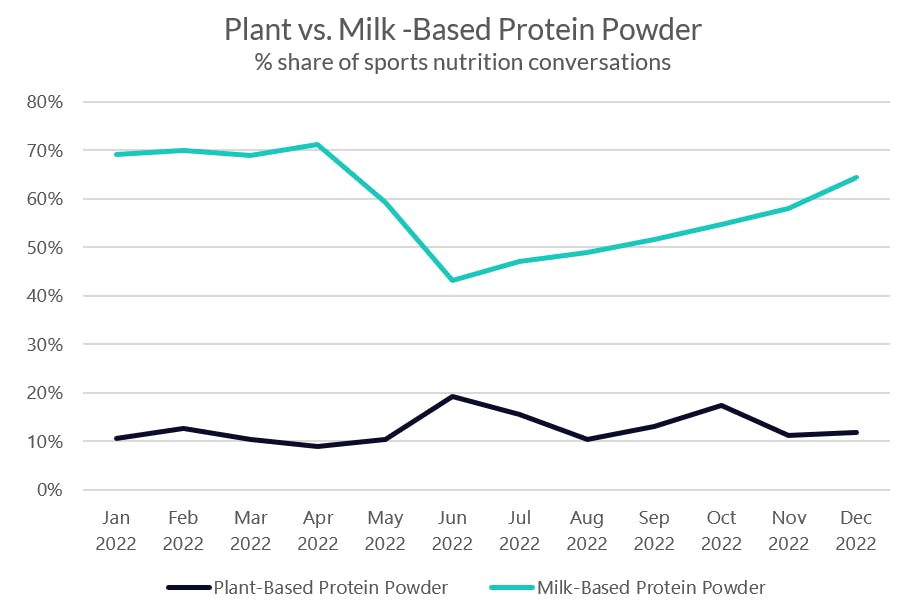

The most talked about sports nutrition product in 2022 was milk-based protein powders. With brands and influencer campaigns active on social media, the category took up 64% of all conversations around sports nutrition this past year. But while most products saw some growth in share of voice, mentions of milk-based protein powders shrunk nearly 20% over 2022 – possible evidence of the products reaching a steady state level of consumer awareness or a lack of product innovation leading to decreased consumer mentions. But it also had to do with the wider plant-based trend.

In spring 2022, conversations around plant-based protein powders picked up as milk-based protein powder conversations declined. Plant-based protein powder did not come close to the volume of its milk-based counterpart, and milk-based protein powder conversations on social media have been increasing ever since. However, discussions around this product type have yet to bounce back to where they were in April 2022.

Although mentions of plant-based protein powder are still relatively modest, with 11% of the share of voice, the product category maintained strong growth and positive sentiment. The category reached peak share of voice in June 2022, taking up 19% of sports nutrition conversations online.

Sports drinks were the second-most prevalent sports nutrition products in social conversations this year. The most chatter around sports drinks happened over the summer months, peaking in August 2022. Especially for those exercising outdoors, sports drink fans love to discuss their methods of staying hydrated, with #hydration being a top hashtag for these social users.

Ingredients getting the most mentions

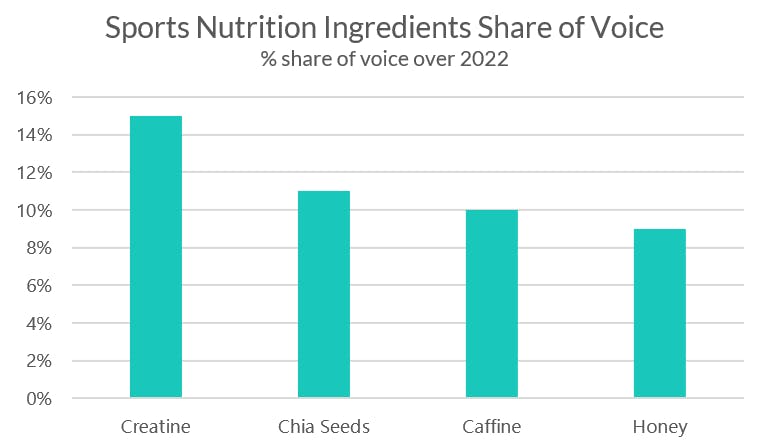

Among sports nutrition ingredients, creatine was the most talked-about ingredient, followed by chia seeds, caffeine, and honey. Creatine remains the most widely discussed sports nutrition ingredient at 15% of the share of voice. The product category does appear to be undergoing some changes with a 42% decrease in mentions between the first and second halves of 2022.

Supplements such as calcium and Vitamin C also saw significant growth in the share of voice. The growth of other wellness ingredients such as Ginseng, Vitamin B12, and Apple Cider Vinegar point to a growing connection between sports nutrition consumers and larger wellness trends.

Sports nutrition seasonal trends

In terms of seasonality, milk-based protein powders saw varied interest throughout the year, with a notable decline during the summer months. Plant-based protein powder appears to follow an inverse trend, declining during the winter months and peaking during the summer. Sports drinks saw a slight increase in discussion during the summer months, potentially due to an increase in outdoor workouts during this time. Recovery drinks also saw a slight increase in discussion during the winter months, possibly due to the increased likelihood of intense workouts during this time.

Additionally, discussions of ingredients such as creatine appear to increase early in the year as athletes are gearing back up for heavy training. Mentions of caffeine, collagen, and other supplements tend to increase in the summer months as workouts move outdoors and athletes look to optimize their training.

Overall, 2022 saw continued interest in sports nutrition products among consumers, with a focus on protein powders, recovery drinks, and sports gummies. Specific ingredients such as creatine, caffeine, and vitamins also made their way into consumer conversations.

Although the global sports nutrition market is highly competitive, brands still have many opportunities to innovate. We see an increasingly health-conscious consumer base and a growing awareness of the benefits of sports nutrition products. Accordingly, expect to see continued interest in this category in the coming years.

Editor’s note: Buyers and suppliers of sports nutrition products can connect in private, prescheduled face-to-face meetings at ECRM’s upcoming Vitamin, Weight Management & Sports Nutrition Session, Spetember 10-13 in Bonita Springs, Fla.

About Brightfield Group

Brightfield Group’s AI-driven consumer insights and social listening platforms help innovators in wellness see the person behind the trend. On the Brightfield Blog, we share actionable insights to showcase the power of our data and keep the industry innovating.

The post The Latest Consumer Buzz About Sports Nutrition Products appeared first on The RangeMe Blog.